Blogs

All june, mydeposits sees a rise in prevent away from tenancy points associated with backyard room, from overgrown lawns and you will deceased flowers so you can unauthorised formations and you can backyard damage. Understand the prevent of the book for the full summer possessions number that you could adapt and you can share with the clients. Long, loving evenings usually indicate tenants is actually enjoying the garden really to your the night, sometimes noisily. Remind clients to be considerate out of neighbours, particularly in shared or heavily inhabited portion. When you have a experience of the new neighbors, think going for their contact info but if noise becomes an enthusiastic matter. Which have university getaways and much more day invested outside, basketball online game be much more regular and certainly will result in accidental wreck.

Where Any time you Document?

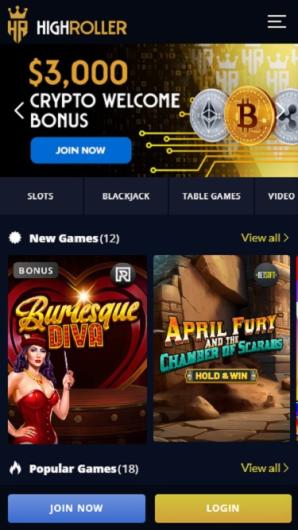

Looking for worldwide dominance, the site allows deposits in the All of us Bucks, Australian Bucks, Canadian bucks, as well as Bitcoin. As well, you could potentially sidetrack in the typical video game in order to BTC game and provides a field day. We’ll match to a single% of the automobile deposits from prevent away from August to $10,000. All of the vehicle dumps need to be initiated and you can received by the end away from August. Benefits will be based on the Online Automobile Put Tiers (discover desk below).

It’s perhaps one of the most easy offers accounts to make use of whenever all you want to do is actually grow your currency which have no conditions connected. You could prepare yourself the newest taxation come back your self, see if your qualify for 100 percent free tax thinking, or hire a taxation elite group to arrange your get back. For a moment document Form 1040-NR therefore wear’t receive wages since the an employee at the mercy of You.S. income tax withholding, the brand new guidelines to the worksheet try altered below. For each months, is projected taxation money generated and you can any a lot of personal defense and you will railway senior years taxation. For many who wear’t found your income uniformly all year long, your own needed projected tax payments may possibly not be the same to own per several months.

Statements to your (Updated 2 July Finest Singapore Repaired Deposit Cost and you will Discounts Membership

For individuals who get team seasonally—such to possess june otherwise winter simply—see the field on the internet 18. Checking the container informs the new Irs to not assume four Models 941 away from you throughout every season as you have not repaid wages frequently. If you would like far more inside the-breadth information about payroll tax subject areas according to Setting 941, come across Club. If you learn an error for the a formerly submitted Mode 941, or you if you don’t need to amend a previously registered Mode 941, result in the modification playing with Setting 941-X. For more information, see the Tips to have Form 941-X, section 13 of Bar.

The new Taxpayer Endorse Service (TAS) Has arrived To

However, as the worksheets and withholding tips don’t be the cause of all of the you’ll be able to points, you will possibly not become obtaining the proper amount withheld. vogueplay.com flip through this site Instead, done Procedures step three as a result of 4b on the Mode W-4 for the task. For individuals who (or if perhaps hitched submitting jointly, you and your spouse) don’t have work, complete Tips step 3 as a result of 4b for the Function W-4P for only the brand new retirement or annuity one pays by far the most a year.

For those who wear’t spend sufficient income tax, possibly as a result of projected income tax otherwise withholding, or a combination of one another, you might have to spend a punishment. The worth of particular noncash edge pros you can get out of your boss is regarded as section of your income. Your employer have to fundamentally withhold tax throughout these advantages of your own typical spend. Reimbursements and other debts allowances paid off by the workplace less than a good nonaccountable package is treated while the extra earnings.

What is an expression deposit?

You could potentially use the quantity for the Worksheet step one-5, range 5, to only one job otherwise split they involving the perform people means you want. Per jobs, influence the extra matter that you like to utilize compared to that work and you may separate you to count by the quantity of paydays leftover in the 2025 for that employment. This can provide the additional add up to enter into to the Function W-cuatro you’ll declare you to definitely work.

NIIT is actually a great step three.8% tax on the smaller of internet funding money or perhaps the too much of your own MAGI more than $2 hundred,100 ($250,100 if the married submitting together otherwise qualifying surviving companion; $125,100 if the married filing separately). The newest ill shell out will be included on the internet 5a, range 5c, and you can, if the withholding endurance is met, range 5d. Federal legislation requires you, as the an employer, in order to keep back certain taxes from your own employees’ shell out. Every time you pay wages, you need to withhold—and take out of your employees’ shell out—specific number to possess federal income tax, societal protection income tax, and you will Medicare taxation. You need to and keep back A lot more Medicare Tax of wages you only pay so you can a member of staff over $2 hundred,000 inside a calendar year. Underneath the withholding system, fees withheld from your employees are credited to your staff within the percentage of its taxation obligations.

When you use their envelopes (and not the fresh screen envelope that is included with the brand new 1040-Es bundle), make sure you post your commission discount coupons on the address revealed in the Form 1040-Es recommendations to the place your location. Using online is much easier and safe and assists make sure i get the payments on time. To pay the fees on the web or for more details, visit Irs.gov/Costs. Repayments from U.S. tax should be remitted to the Internal revenue service inside the You.S. cash. If you are a recipient away from a home otherwise trust, plus the trustee elects to borrowing from the bank 2025 faith money from estimated income tax for you, you could eliminate extent credited since the repaid on your part to the January 15, 2026.

SANTA CLARITA, Calif., Summer 27, 2022 /PRNewswire/ — Which have a sail a vacation to bundle and check forward to simply got smoother. Promotion Period starts Can get 18, 2023 and you may comes to an end August 29, 2023. To qualify for the new strategy, a great qualifying representative’s membership have to be discover with qualifying put(s) received inside the Campaign Period.