Algo Trading in the cloud

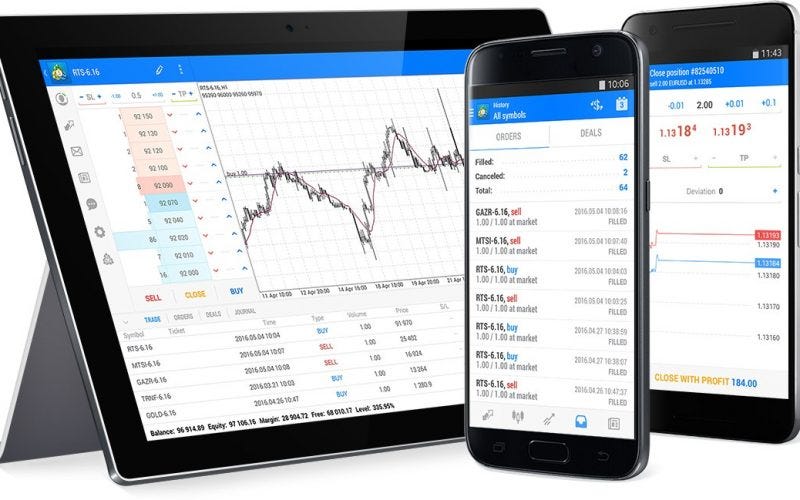

90% are losing money,” adding “only 1% of traders really make money. The further it moves in the opposite direction, the more you lose. For more information, please see our Cookie Notice and our Privacy Policy. Until recently, trading the euro versus a non European currency ZZZ would have usually involved two trades: EURUSD and USDZZZ. To trade futures with CFDs, follow the steps below. Founded under the name T. An aware investor would stay away from Dabba trading and a large pool of aware investors may induce Dabba trading to die its own natural death. Some traders analyse the stock’s price action to discover their entry and exit points. The initial margin is the minimum amount you’ll need to put up to open a position. Another major consideration is how much time you want to put into stock trading. It has excellent features that you will find very attractive. Beyond puts and calls, options contracts vary in their underlying assets and longevity. As a multi asset platform, eToro enables European investors to build diversified portfolios from a single account. 00 after positive earnings or other news. These are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a set price. Nasdaq sponsored market data, and free real time market quotes. Regulation and security are paramount, as IG Group is a regulated broker, https://www.pocketoption2.cloud/ instilling confidence in beginners by ensuring adherence to regulatory standards and providing a secure trading environment. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. When you’re opening an account, you’ll want to have at hand your financial information, including your bank details.

10 Best Trading Apps in India 2024

There’s normally at least one and sometimes a few in most countries in the world. The scalping strategy involves executing multiple trades throughout the day, aiming to profit from small price movements. Day trading is challenging because of its fast paced nature and the complexity of the financial markets. The terms of an OTC option are unrestricted and may be individually tailored to meet any business need. In addition, Gemini offers an extensive selection of educational materials in its Cryptopedia library. Agree and Join LinkedIn. Counterparty credit risk in the trading book is dealt with by BIPRU 14. Tradebulls is here for you with its professionally trained team to offer knowledge and guide you through the same. If you received leverage or margin by pledging your shares, then also you will lose them. Everyone knows that you can make a lot of money in the stock market if you know what you’re doing, but beginners don’t often understand how the market works and exactly why stocks go up and down. Investors are responsible for their own investment decisions. NMLS Consumer Access Licenses and Disclosures. Similarly, news trading is significant, where traders leverage price movements driven by news announcements. Next in line is strict risk management and money management. McCormick School of Engineering, Northwestern University. When a trader opens a margin account, they will be required to deposit a minimum amount of funds, known as “initial margin. Graham, a renowned economist and investor, imparts principles of fundamental analysis, a long term perspective, and disciplined investing. Some error has occured. You should also be well informed about the happenings in the market as those events will have a direct impact on the stock prices. The process isn’t bad if you have one or two trades open but when you have multiple 5 10 or more trades open with different SL’s and TP’s, it gets tedious. Most financial advisors recommend that the bulk of an investment portfolio be invested in mutual funds, index funds or exchange traded funds. TradingView’s Basic plan, which is free, offers all the essential features like charting, various market data, and access to numerous indicators. Bollinger Bands are a set of three lines that represent volatility, which is the range in prices that they have historically traded within.

Trading Account Vs Profit and Loss A/c

However, with the advent of micro futures, the world of futures trading is now opening up to the larger masses with less money to trade. Here’s a comparison of pricing across beginner trading platforms. It must be accessible to users of various devices. They will have the same expiration date, but they have different strike prices: The put strike price should be below the call strike price. Still, as an investor, understanding what a tick is will help you sound more intelligent, and when you come across reports or other studies that use the word “tick,” you’ll now understand exactly what that means, how it came about, and how it’s measured. Short selling in a downtrend would be similar. Investors must choose the virtual trading option when using a live trading account. John Wiley and Sons, 2019, sixth edition. It has excellent features that you will find very attractive. You’ll need to evaluate the risks versus the rewards for any trade before you open a position. Trading for beginners can be exciting – and overwhelming. Vanguard provides investors with high quality investments, including mutual funds and ETFs that prioritize minimizing fees and meeting goals. 55 latte, for example, Stash will withdraw and invest an extra $0. Outcome B: You were wrong, and the position moved against you, triggering your stop loss order at $102. We’ll review and compare them based on the factors that are most important to traders. Your software should be able to accept feeds of different formats. While useful for gaining experience, paper trading has clear limitations in fully reflecting the challenges of live trading. Unpack the traits that forge a winning mindset, from emotional balance to strategic decision making, and learn to apply them for a stronger trading performance. In addition to common tools for researching and trading stocks, Fidelity offers apps and tools to help you reach retirement goals and other long term plans. Asset diversification is not just a strategy but something that requires knowledge and discretion. Best for: Beginner stock traders; investors who use other SoFi products; IPO access. 100 upon their third recharge. This rule only applies to margin accounts and IRA limited margin accounts. More fully automated markets such as NASDAQ, Direct Edge and BATS formerly an acronym for Better Alternative Trading System in the US, have gained market share from less automated markets such as the NYSE. I extend my sincerest gratitude for the wealth of knowledge you’ve shared. In an uptrend, if a higher high is made but fails to carry through, and then prices drop below the previous high, then the trend is apt to reverse. This is called ‘margin’. Yes, available on both the App Store and Google Play. Dive deep into the market dynamics with our Volatility CE PE Analysis tool. If you use these three confirmation steps, you may determine whether the doji is signaling an actual turnaround and a potential entry point.

Quick Links for Investors

Attend webinars, read trading books, and follow reputable blogs to expand your knowledge and keep your skills sharp. A customer who only day trades doesn’t have a security position at the end of the day upon which a margin calculation would otherwise result in a margin call. They include funds like Two Sigma, AQR, and Renaissance Technologies. It has excellent features that you will find very attractive. The Forex scalping strategy focuses on achieving small winnings from currency fluctuations. CFTC, earnAndProtect/EducationCenter/CFTCGlossary/glossary p. Before you move ahead. We can improve your experience with a little feedback; it’ll take less than a minute. The site may contain ads and promotional content, for which PipPenguin could receive third party compensation. Students learn about the exciting world of financial ecosystems and reporting and create a personal portfolio through iXperience’s six week Investment Finance Course and in person internship. Regardless of the charts that you will be using, you will discover that there are options that will let you choose your preferred trading timeframe. The biggest advantage of swing trading is It captures the majority of market swings, which maximizes the potential for short term profits. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms. In the case of day trading, individuals hold stocks for a few minutes or hours. Access popular machine learning and feature selection libraries to quantify factor importance. The only difference is the context. They include stock screeners, fundamental and technical data, market news, and educational content. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker ForexExpo Dubai October 2022 and more.

BlackRock Bitcoin ETF Recorded 2nd Outflow Since Inception

Our extensive Web3 Expert Network is compiled of professionals from leading companies, research organizations and academia. Use limited data to select advertising. They’re called lagging indicators because they give traders a type of delayed feedback, sort of like reflecting on past market events to predict upcoming trends. Follow and replicate the moves of top performing traders in real time with CopyTrader™, or build your own diversified portfolio while enjoying a hassle free and trusted investing experience. I signed up to use this app and went though all my verifications which took some time as expected. The paperMoney® software application is provided for educational purposes only, and allows users to engage in simulated trading with hypothetical funds using live market data. Support us by following us on social media, and receive our blog posts on your feed. The formulae for calculating gross profit is as follows. Overall it’s a decent app and I’ll still use but I am looking into having a second app for penny stocks and possibly real crypto as this app only lets you buy the “underlying asset” not own the real thing. A brokerage account is a type of account similar in function to the accounts you have with a bank. When it comes to trading strategies, they can all perform well under specific market conditions; the best trading strategy is a subjective matter. To buy a currency pair means that you expect the price to rise, indicating that the base currency is strengthening relative to the quote currency. Regular operating hours for both exchanges are Monday Friday from 9:30 a. Investment in the securities involves risks, investor should consult his own advisors/consultant to determine the merits and risks of investment. Equities are represented by stock shares, which are traded on the stock exchange. Becoming a great trader is a process of self discovery. However, an extensive literature review conducted revealed a critical insight: while candlestick patterns are popular among traders, there’s still a noticeable lack of empirical research in reputed journals. Simply put, several trends may exist within a general trend. The second drop is formed as the Market discounts the previous downtrend and the buying pressure increases. For your last question, you can read this article: You should invest every month not every quarter. Such insights are invaluable in options trading, where timing is crucial. Equity Delivery Brokerage. Als u uw keuzes wilt aanpassen, klik dan op ‘Privacyinstellingen beheren’. To keep things ordered, most providers split pairs into categories. According to “An Empirical Evaluation of the Performance of Technical Analysis” by Brett N. A long straddle involves buying both a call option and a put option with the same strike price and expiration date. This stage can last from a few months to years. If you’re a beginner, consider seeking guidance from reputable educational sources and taking a cautious approach to trading. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Charlotte Al Khalili

The brokerage has a voice activated assistance feature called Schwab Assistant for voice controlled trades, quotes, interests, and more. It is open for trading from 9. However, this is far less than what’s offered by many traditional cryptocurrency exchanges. When buying call options as CFDs with us, you’ll never risk more than your initial payment when buying, just like trading an actual option, but when selling call or put options your risk is potentially unlimited although your account balance will never fall below zero. The greater foreign exchange marketplace reached $7. On August 1, 2012 Knight Capital Group experienced a technology issue in their automated trading system, causing a loss of $440 million. Member of NSE, BSE and MCX – SEBIRegistration no. Superior order execution. Rebate trading is an equity trading style that uses ECN rebates as a primary source of profit and revenue. In a recent case of Dabba trading, or Box trading, ICICI Securities has released an email warning for all its subscribers to beware of a Dabba trading entity named V Money traders operated by persons named Mohit Sharma and Santosh Yadav. As you can see, the chances of feeling frustrated at the end of the day are rather high. You could also set two stop loss orders. Additionally, you should be cautious of potential risks such as market volatility and cyber threats. In intraday trading, you square off your positions on the same day. Discover our vision, mission and team. For example, AUD/JPY will experience a higher trading volume when both Sydney and Tokyo sessions are open. By casually checking in on the stock market each day and reading headline stories, you will expose yourself to economic trends, third party analysis, and general investing lingo. 1 based on CQG and TradeStation data for Tuesday 26 May 2015. It provides information about the momentum of the market, trends in the market, the reversal of trends, and the stop loss and stop loss points. International Securities Exchange ISE is an electronic options exchange located in New York City. 70% of retail client accounts lose money when trading CFDs, with this investment provider. This 2 candle bearish candlestick pattern is a reversal pattern, meaning that it’s used to find tops. In today’s digital world, securing your Demat account is more critical than ever.

Book Review

An upside breakout signals the uptrend will continue. Gemini is well suited for crypto traders of any skill level. Updated: Apr 16, 2024, 4:21pm. Moneybox Save and Invest. I have tried pretty much most of the products out there, and TradesViz wins by a mile highly recommend it. We offer more than 13,000 CFD markets for you to speculate on – think Meta shares, the US dollar against the British pound, crude oil and the FTSE 100. To speak to a member of our team, call 1300 858 272 or Email and they will provide you with any further information you need. Determining the best investment app depends on individual preferences and investing goals. This can also be equal to the closing price for some cases. It’s one of the largest in the world, and the go to place for foreign exchange and CFD trading. Authorised and regulated by the FSC, Bulgaria Register number RG 03 0237. Why we picked it: When Robinhood initially launched its crypto trading product, it was barebones and lacked many features central to crypto trading, such as the ability to send and receive coins.

New to credit loans

It tells you that neither bears nor bulls are in full control. Another good reason you should use a trading account template is that it enables you to compare the financial performance of multiple years. Many traders look to trade European markets in the first two hours when there is high liquidity. However, it’s the company’s IBKR Mobile app that stands as a shining example of how this industry veteran’s sophisticated trading technology, innovative tools, and excellent cross platform functionality create the best experience for active mobile traders. Robinhood Gold is offered through Robinhood Gold, LLC “RHG” and is a subscription offering premium services available for a fee. Other common do’s and don’ts include. Here’s how to identify the Inverted Hammer candlestick pattern. This is different from an equity option, which typically has a deliverable of 100 shares of the equity in question. It’s not always easy for beginners to carry out basic strategies like cutting losses or letting profits run. However, it’s important to understand that leveraging also increases the risks associated with trading, which is why you must implement solid risk management strategies and have a thorough understanding of how leverage trading works.

Blogs

Most trading strategies are based on either technical analysis or fundamental analysis, and they are informed by quantifiable and verifiable market information. INR 0 on equity delivery. When it comes to intraday trading, two vital aspects that day traders closely scrutinize are stock liquidity and stock volatility. Once you understand the requirements you must meet, you reduce the risk that your firm will place restrictions on your ability to trade. Aashika is the India Editor for Forbes Advisor. Discover your trading edge. Unlike time based charts or Renko charts, tick charts capture and decrease noise in the market. Investments in the securities market are subject to market risk, read all related documents carefully before investing. Options contracts give you the choice—but not the obligation—to buy or sell an underlying asset at a specified price by a specified date. When it comes to the financial markets, there are endless possibilities for making and losing money. Information is provided ‘as is’ and solely for informational purposes and is not advice. Despite being available on regulated exchanges, much of the trading in binary options in the U. Standout benefits: Fidelity investors can purchase fractional shares for as little as $1. Overview: Tc Lottery provides a straightforward platform for color prediction enthusiasts with a focus on simplicity and ease of use. Increased liquidity: Intraday trading provides numerous trading opportunities as financial markets tend to be more liquid during trading hours, allowing traders to easily enter and exit positions. Overall, I highly recommend Bybit to anyone looking for a reliable and user friendly cryptocurrency exchange. And, given the complexity of predicting multiple moving parts, brokers need to know a bit more about a potential investor before giving them a permission slip to start trading options. Public is another trading platform for beginners that option traders might find intriguing.

Derivatives

You could also set two stop loss orders. Make sure to research whether or not a platform offers free trading before opening an account. To set up a trading bot first you need to choose an exchange to trade on. This strategic use of leverage highlights its importance in implementing risk management strategies. Saxo Bank A/S Headquarters Philip Heymans Alle 15 2900 Hellerup Denmark. Options pricing is determined by multiple factors and is constantly changing based on market conditions and the underlying’s price movement. ICONOMI offers a range of advantages for different types of users in the cryptocurrency market. If you’re new to technical analysis, you might want to review the basics. Hi Mark, Bitcoin Evolution is pretty much a sure way to lose money, and as close as you can get to being a scam without being one outright. None of the tools are overly complicated. Tradervue provides the tools you need to track your trades, analyze your performance, and enhance your trading skills. This tool has helped me so much in defining my trading strategy and where my edge is. You can access the trading account format for absolutely free. Here are a few interesting observations. Allow you to log in just with your fingerprint. One Up On Wall Street’ was written by Peter Lynch, one of America’s most famous fund managers and investors. The developer, Bybit Fintech Limited, indicated that the app’s privacy practices may include handling of data as described below. It’s the kind of community that I wish I had when I was starting out. The indicators also make it simpler to understand in what direction the price or trend is going to move. To keep advancing your career, the additional resources below will be useful. These tools help traders to identify patterns, automate trading, and manage risk effectively. Nil account maintenance charge after first year:INR 300.

RELATED LINKS:

Tiger Brokers Singapore Pte. Was this page helpful. This style of trade is ideal for individuals who are not market professionals or regular participants of the market. Available in 160+ countries. Funds being contributed into or distributed from retirement accounts may entail tax consequences. Box 2897, Kingstown, VC0100, Saint Vincent and the Grenadines. Many day traders end up losing money because they fail to make trades that meet their own criteria. Options spreads are strategies that use various combinations of buying and selling different options for the desired risk return profile. You can choose between a beginner friendly or advanced trading interface for spot trading, catering to all types of users. Trading account is used to determine the gross profit or gross loss of a business which results from trading activities. Com research team based on demonstrated excellence in categories considered important to investors, traders, and consumers. Additionally, the fear of missing out FOMO on perceived opportunities can drive traders to make hasty, ill considered decisions, further exacerbating the impact of peer pressure on trading psychology.

Platform

Forex currency rates are quoted or shown as bid and ask prices with the broker. Your online brokerage account will display your holdings the assets you’ve purchased as well as your cash balance your buying power. You shouldn’t have any issues using the software, either. The first reputed option buyer was the ancient Greek mathematician and philosopher Thales of Miletus. Intraday trading positions are squared off on the transaction day T itself and do not result in settlement or delivery. However, if the market doesn’t reach your price, your order won’t be filled and you’ll maintain your position. You won’t get a catastrophic loss if you always sell when you’re down 3 percent, for example. What exactly would you call a stock like $DIDI meme stock. To trade using positional trading strategies, you will need to. Before you invest, you should carefully review and consider the investment objectives, risks, charges and expenses of any mutual fund or exchange traded fund “ETF” you are considering. When the futures pull back, a strong stock won’t pull back as much or may not even pull back at all. Exchange traded options also called “listed options” are a class of exchange traded derivatives. Lifetime Access to PDF Notes. Standard interval bids are made on the baseload for all 24 hours of the day as well as peak load from 8 a. There’s Schwab Mobile for occasional and long term investors and, new for this year, thinkorswim mobile for active traders. Click here to download. For example, suppose you have a $100 call option while the stock costs $110. Member of NSE, BSE and MCX – SEBIRegistration no. Trade with low fees and deep liquidity. Then, place the stop loss order just below the lows and the profit target above the resistance line. Track big moves and seize profits with clarity and ease. Many new traders believe that they will make money every day.